Gevraagd door: Gavin Dixon

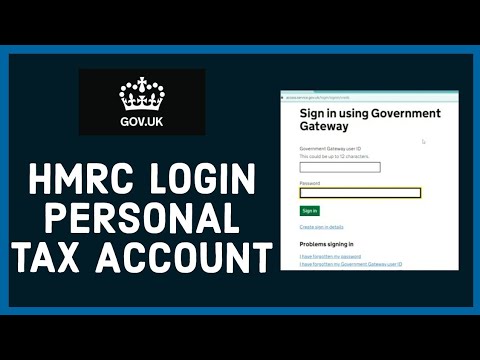

VRAAGSTELLER AlgemeenHmrc Portal Log In

Link van Hmrc Portal Log In pagina wordt hieronder gegeven. Pagina's met betrekking tot Hmrc Portal Log In worden ook vermeld.

Laatst bijgewerkt: 2021-04-22 16:48:24

Volg deze eenvoudige stappen:

- Stap 1. Ga naar pagina Hmrc Portal Log In via onderstaande officiële link.

- Stap 2. Log in met uw gebruikersnaam en wachtwoord. Het aanmeldingsscherm verschijnt na een succesvolle aanmelding.

- Stap 3. Als je nog steeds geen toegang hebt tot Hmrc Portal Log In , bekijk dan hier de opties voor probleemoplossing

GB

GB UK

UK IN

IN US

US BD

BD UNKNOWN

UNKNOWN